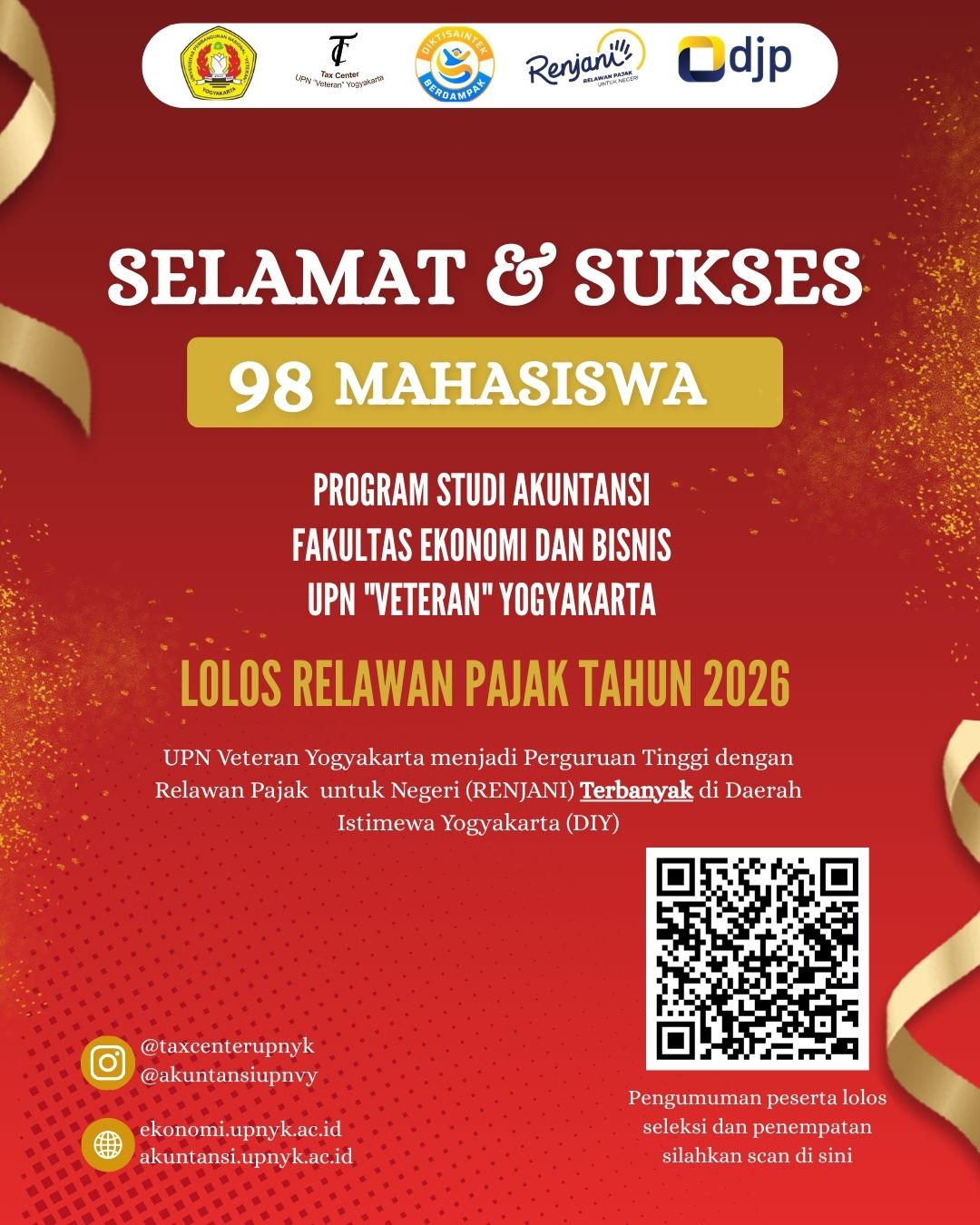

98 Accounting Students of UPN “Veteran” Yogyakarta Selected for the 2026 Tax Volunteers for the Nation (RENJANI) Program

The Accounting Study Program, Faculty of Economics and Business, UPN “Veteran” Yogyakarta, has once again achieved a remarkable accomplishment. A total of 98 students have been officially selected for the 2026 Tax Volunteers for the Nation (Relawan Pajak untuk Negeri/RENJANI) Program, making UPN “Veteran” Yogyakarta the university with the highest number of Tax Volunteers in the Special Region of Yogyakarta (DIY).

This achievement reflects a significant and consistent increase in student participation and competency from year to year. Based on data from the Tax Center of UPN “Veteran” Yogyakarta, the number of students passing the RENJANI selection has shown steady growth, with 43 students in 2024, 59 students in 2025, and a substantial rise to 98 students in 2026. This trend demonstrates the growing awareness, competence, and commitment of students to actively contribute to the national taxation system.

In 2026, RENJANI UPN “Veteran” Yogyakarta also gains a strategic opportunity to participate in the Merdeka Belajar Kampus Merdeka (MBKM) program in collaboration with the Directorate General of Taxes (DGT). Through this scheme, students will not only assist taxpayers in fulfilling their tax obligations but also acquire hands-on experience that aligns with professional practice and national fiscal policies.

RENJANI is a flagship and sustainable program managed by the Tax Center of UPN “Veteran” Yogyakarta in collaboration with the Directorate General of Taxes. In addition to RENJANI, the Tax Center continuously implements various programs aimed at strengthening tax literacy and professional competence, including:

- Tax Brevet Certification A/B

- Certified Tax Technician Program

- BNSP Certification in Tax Administration

- Tax Corner (Pojok Pajak)

- Tax Inclusion Programs

- Tax Webinars and public tax education activities

Through these initiatives, the Tax Center of UPN “Veteran” Yogyakarta remains committed to producing competent, ethical, and socially responsible graduates who are ready to contribute meaningfully to improving public awareness and compliance in taxation.